The Yen Carry Trade was a popular investment strategy that took advantage of Japan’s low interest rates. Investors borrowed money in Japanese Yen at very low rates and then invested that money in assets with higher returns in other countries. This strategy allowed investors to profit from the difference in interest rates between Japan and other nations.

You might wonder why this was possible. For many years, Japan had very low interest rates to try to boost its economy. At the same time, other countries had much higher rates. This gap created a chance for investors to make money.

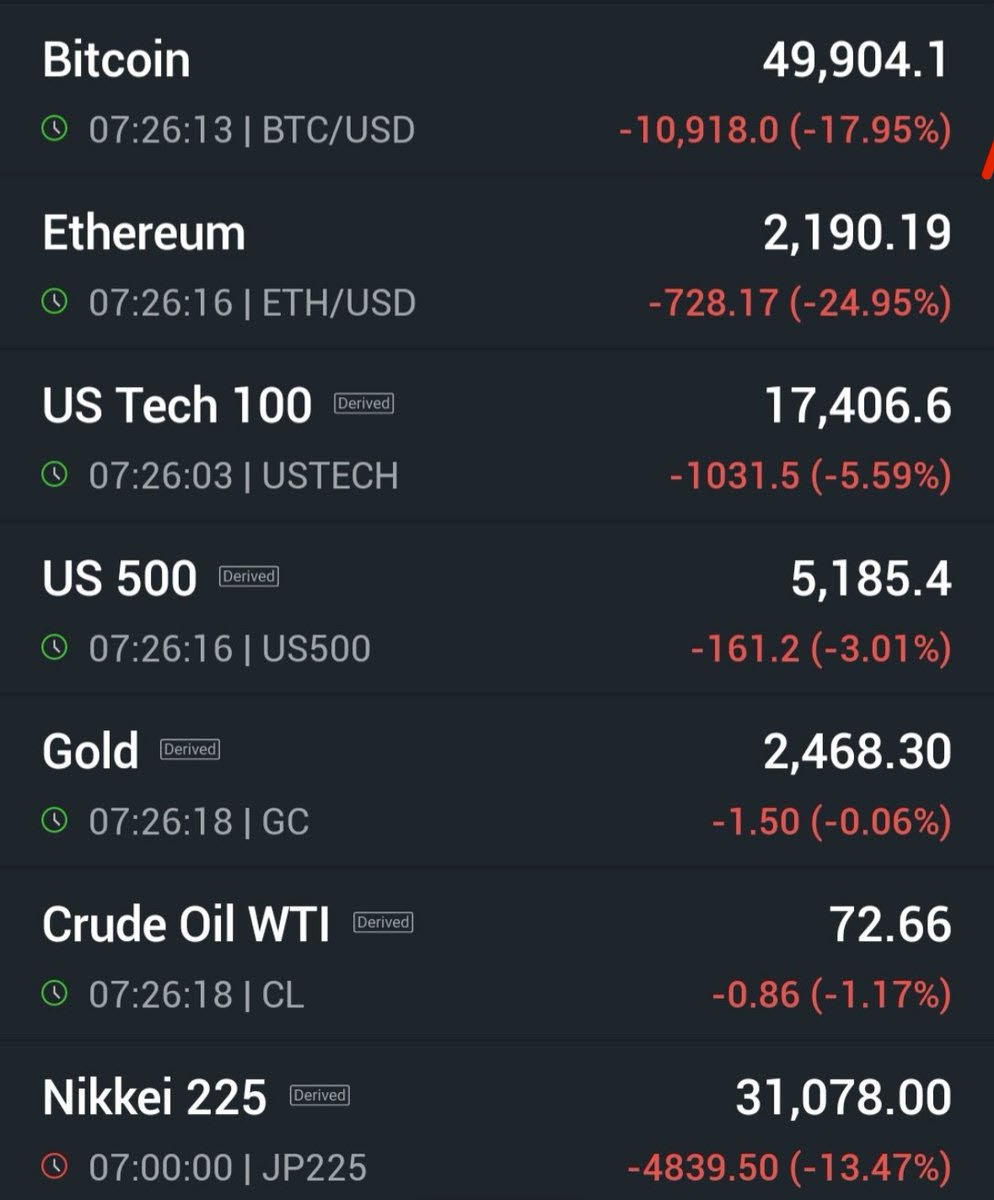

Many banks, hedge funds, and even regular retail traders used this method. It helped fuel investment in many parts of the world. But it also had risks, like sudden changes in exchange rates that could wipe out profits like we saw during early market trading on August 5th, 2024.

Key Takeaways

- The Yen Carry Trade let investors profit from interest rate differences between Japan and other countries

- This strategy affected global markets and currency exchange rates

- The trade carried risks, including potential losses from sudden Yen value changes

Concept and Mechanics of Carry Trade

Carry trades involve borrowing money in a low-interest currency to invest in higher-yielding assets. The Japanese yen played a key role in this strategy for many years due to Japan’s ultra-low interest rates.

Definition of Carry Trade

A carry trade is when you borrow money in a country with low interest rates and invest it in another country with higher rates. You profit from the difference between the two rates. This strategy works best when exchange rates stay stable.

Carry trades can be risky. If the exchange rate moves against you, you might lose money. For example, if you borrow yen and buy U.S. dollars, a stronger yen could wipe out your gains.

Investors often use carry trades to boost returns. They may borrow large sums to increase potential profits. This can lead to big gains, but also big losses if things go wrong, hence seeing the Nikkei down 12% and the US stock market futures were down 6% before the open.

The Role of the Yen in Carry Trades

The Japanese yen was popular for carry trades due to Japan’s very low interest rates. For many years, you could borrow yen cheaply and invest in higher-yielding currencies like the U.S. dollar or Australian dollar.

This strategy became known as the “yen carry trade.” It was widely used by investors and hedge funds. The trade worked well when the yen was weak or stable against other major currencies.

But the yen carry trade had risks. When the yen strengthened sharply, as it did, many investors lost money as the debt they had in Yen was now more expensive to sell assets in other currencies. This showed how carry trades can be profitable but also incredibly dangerous.

Factors Influencing the Yen Carry Trade

The yen carry trade was shaped by several key elements. These included monetary policies, global economic conditions, and the differences in interest rates between Japan and other countries.

Bank of Japan’s Monetary Policy

The Bank of Japan’s decisions played a crucial role in the yen carry trade. Their low interest rate policy made the yen an attractive funding currency. You could borrow yen cheaply and invest in higher-yielding assets elsewhere.

In the 1990s, Japan faced economic troubles. To boost growth, the Bank of Japan cut interest rates to near zero. This policy stayed in place for many years. It made the yen perfect for carry trades.

The Bank also used quantitative easing. This further weakened the yen and supported carry trades. When the Bank hinted at policy changes, it could quickly affect carry trade activity.

Interest Rate Differentials

The gap between Japan’s low rates and higher rates elsewhere was the core of the yen carry trade. The wider this gap, the more appealing the trade became.

Countries like Australia and New Zealand often had much higher rates than Japan. This made their currencies popular targets for carry traders. The U.S. dollar was also a common choice, especially when the Federal Reserve raised rates.

You needed to watch these differentials closely. Changes in global rates (both interest rate and exchange rate) could quickly affect the profitability of carry trades. Central bank decisions in target countries were just as important as those in Japan.

Risks and Unwinding of Carry Trades

Carry trades involve many potential risks and can unwind rapidly in certain market conditions. You need to be aware of how volatility impacts these trades and understand the process of unwinding.

Market Volatility and Carry Trades

Market volatility poses a major risk to carry trades. When markets become unstable, your investments may face sudden losses. Exchange rates can shift quickly, erasing profits or causing steep declines.

High volatility often leads to a “flight to safety.” Investors rush to sell riskier assets and buy safer ones as we saw on August 5th, 2024, with the panic selling of equities to buy bonds as rate cuts are expected from the US Federal Reserve soon. This will cause carry trade currencies like the US Dollar to fall sharply against funding currencies like the yen.

Process of Unwinding Carry Trades

Unwinding happens when you close out carry trade positions. This often occurs during market stress or when interest rate differentials narrow.

As the first traders sell more traders are forced to sell as their position values decline, it can create a snowball effect. Selling pressure builds on the target currency, while demand for the funding currency rises. This further hurts any remaining carry trade positions.

Unwinding can happen rapidly, especially with leveraged trades. You may face margin calls or stop-loss orders triggering automatically. This forces you to sell at unfavorable prices.

Conclusion on the Yen Carry Trade

Ending today’s post with a meme I found on X and linking to a very insightful podcast episode from Goldman Sachs.