In today’s incredibly volatile markets, finding ways to reduce your portfolio’s overall risk without sacrificing returns remains a top priority for investors. Private credit has emerged as a compelling option to achieve this balance, offering potentially attractive yields with lower correlation to public markets. Adding a strategic allocation to private credit can meaningfully reduce your portfolio beta while potentially enhancing risk-adjusted returns through diversification beyond traditional fixed income and equity investments.

Private credit investments typically involve direct loans to companies that fall outside the public financing channels. This alternative asset class can help you reduce economic cycle risk, duration risk, and inflation risk, thereby lowering your overall portfolio volatility. Many institutional investors have already recognized this benefit, with some reallocating portions of their traditional 60/40 portfolios to include a 5% or greater allocation to private credit strategies.

When constructing your investment strategy, it’s important to consider how private credit fits within your broader portfolio. The asset class offers lower correlation to other investments, providing true diversification benefits during market stress. However, you must carefully evaluate the different types of private credit strategies available and their unique risk-return profiles to avoid common allocation mistakes and ensure alignment with your specific investment objectives.

Understanding Portfolio Beta

Portfolio beta measures your investment’s sensitivity to market movements, providing crucial insight into your portfolio’s risk profile relative to the broader market. This metric helps you gauge potential volatility and make informed decisions about asset allocation.

Basics of Beta and Market Risk

Beta represents the systematic risk or volatility of a security or portfolio compared to the market. A beta of 1.0 indicates that your investment moves in line with the market. When beta exceeds 1.0, your portfolio demonstrates higher volatility than the market, potentially yielding greater returns but with increased risk.

Conversely, a beta below 1.0 suggests lower volatility than the market. This measurement is fundamental to the Capital Asset Pricing Model (CAPM), which quantifies the relationship between risk and expected equity returns.

To calculate your portfolio beta, multiply each security’s beta by its proportional value in the portfolio, then sum these products. This weighted approach reflects your overall market risk exposure for your portfolio.

The Impact of Beta on Investment Portfolio

Your portfolio beta significantly influences investment performance across different market conditions. High-beta securities tend to outperform during bull markets but may experience steeper declines during downturns. Low-beta investments typically offer more stability during market volatility.

Beta serves as a valuable tool when assessing alternative investment strategies as part of a diversified portfolio. By adjusting your beta exposure, you can calibrate your risk-return profile to align with your investment objectives.

Consider these beta ranges for context:

- 0-0.5: Very low market sensitivity

- 0.5-1.0: Below-average market sensitivity

- 1.0: Equal to market

- 1.0-1.5: Above-average market sensitivity

- >1.5: High market sensitivity

Understanding beta helps you evaluate how various asset classes and risk premiums contribute to your portfolio’s overall risk structure.

Private Credit as a Portfolio Stabilizer

Private credit investments offer a powerful mechanism for reducing portfolio volatility while potentially enhancing returns. They serve as effective portfolio stabilizers due to their unique characteristics that differ from traditional public market investments.

Defining Private Credit

Private credit refers to debt financing provided to companies or projects outside of public markets and traditional banking systems. These investments typically involve direct lending to middle-market companies, real estate projects, or specialized financing arrangements not accessible through public exchanges.

Private credit encompasses several strategies including direct lending, mezzanine financing, distressed debt, and specialty finance. The market has expanded significantly as regulatory changes pushed banks away from certain lending activities, creating opportunities for institutional investors.

What makes private credit distinct is its negotiated terms, customized structures, and typically stronger creditor protections. These loans often feature floating rates, making them resilient during rising interest environments.

You can access private credit through private institutional offerings, Fundrise, and a new public ETF: $PRIV to name a few ways. Each investment opportunity has its own risks and benefits, your portfolio size and investment objectives should determine your allocation.

Risk and Return Profile of Private Credit

Private credit offers compelling risk-adjusted returns compared to public fixed income, largely due to the illiquidity premium investors receive for committing capital for extended periods. This premium typically ranges from 200-400 basis points above comparable public securities.

The return profile benefits from contractual income, making cash flows more predictable than equity investments. Most private credit investments generate returns primarily through interest payments rather than capital appreciation.

From a risk perspective, private credit demonstrates lower volatility than public markets due to infrequent pricing and negotiated protections. Loans often include covenants, collateral requirements, and structural features that enhance recovery rates in default scenarios.

Private credit can reduce your portfolio’s overall risk, particularly for investors concerned about systematic risk in public markets and interest rate risks in a rising rate environment. By enabling diversification across unlisted organizations and sectors not represented in public markets, you gain exposure to different economic drivers.

Strategies for Private Credit Investment

Private credit investment strategies offer varied risk-return profiles to help reduce portfolio beta while potentially enhancing yield. Each approach targets different segments of the market with unique characteristics and capital deployment methods.

Direct Lending and Buyouts

Direct lending involves providing loans directly to middle-market companies, often bypassing traditional banking intermediaries. This strategy typically offers yields of 7-10% for senior secured loans, with higher returns possible for junior capital positions.

When implementing direct lending, you should focus on lenders with strong origination networks and credit underwriting capabilities. These loans often feature floating rates, providing a natural hedge against inflation and rising interest rates.

Buyout financing represents another substantial opportunity, where investors provide debt for private equity acquisitions. These loans generally offer stronger covenant protections than broadly syndicated loans.

Consider allocating 5-10% of your portfolio to these strategies, as they typically provide consistent income with lower volatility than public high yield bonds.

Venture Debt and Mezzanine Financing

Venture debt serves growth-stage companies that prefer to avoid equity dilution but need expansion capital. This strategy carries higher risk with potential returns of 12-18% through interest and equity warrants.

You should assess the borrower’s venture capital backing, cash runway, and business model sustainability before investing. Diversification across sectors and vintages is crucial to mitigate concentration risk.

Mezzanine financing bridges the gap between senior debt and equity, offering subordinated capital with higher yields of 10-14%. This hybrid approach provides equity-like upside through warrants or PIK (payment-in-kind) interest while maintaining debt’s downside protection.

Both strategies require longer investment horizons (3-5 years) and offer portfolio diversification benefits due to their low correlation with public markets.

Distressed Credit and Special Situations

Distressed credit involves purchasing debt of financially troubled companies at significant discounts to face value. Returns can range from 15-20%+ depending on entry point and resolution strategy.

This counter-cyclical strategy performs best during economic downturns when asset prices decline. You’ll need specialized expertise to evaluate bankruptcy processes, debt restructuring, and liquidation scenarios.

Special situations investing encompasses opportunistic credit investments with catalysts like corporate events, regulatory changes, or asset sales. These time-sensitive opportunities require quick analysis and execution.

Consider allocating capital to managers with proven track records across multiple credit cycles. A diversified approach combining these strategies can help you optimize risk-adjusted returns while reducing your portfolio’s overall correlation to public markets.

Integrating Private Credit into an Existing Portfolio

Adding private credit to your portfolio requires careful planning and strategic implementation. This alternative asset class can provide meaningful diversification while potentially enhancing risk-adjusted returns when properly allocated.

Asset Allocation and Diversification Benefits

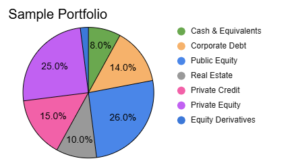

Private credit can serve as a powerful diversification tool in your investment strategy. Traditional portfolios typically allocate 60% to equities and 40% to fixed income, but taking 5% each from stocks and bonds to fund private credit may enhance returns and reduce risk.

Private credit offers exposure to unique asset-backed investments that may not correlate strongly with public markets. This can help smooth portfolio volatility, especially during market downturns.

When allocating to private credit, consider:

- Percentage allocation: Typically 5-15% of total portfolio assets

- Source of funds: Whether to reduce equity or fixed income allocations

- Credit quality mix: Investment-grade vs. higher-yielding opportunities

Private credit provides high quality income without sacrificing credit quality, making it attractive in low-yield environments.

Risk Management and Portfolio Rebalancing

Effective risk management is crucial when incorporating private credit. Be aware that if you create an allocation by reducing existing bond holdings, you will increase your overall credit risk.

Portfolio construction should consider the underlying return components and different risk types. Focus on diversifying across:

- Loan structures: Senior secured, mezzanine, unitranche

- Industries: To minimize sector concentration

- Geography: Domestic vs. international exposure

- Vintage years: Staggering investments over time

Liquidity constraints require careful planning. Unlike public bonds, private credit investments typically involve lockup periods of 3-7 years.

Regular rebalancing is essential, though less frequent than with public assets due to illiquidity. Consider scheduled liquidity events to maintain your target allocation as market conditions evolve.

Evaluating the Cost-Benefit of Private Credit

Adding private credit to your portfolio involves weighing fees against performance potential and considering how long you can commit capital. Proper evaluation requires understanding both the immediate costs and long-term benefits unique to this asset class.

Fees and Performance Analysis

Private credit investments typically carry higher fees than public market alternatives, but recent performance metrics justify this premium for many investors. In the second quarter of 2024, private credit gained 1.8%, performing on par with leveraged loan indices and outperforming high yield indices.

When analyzing fee structures, consider:

- Management fees (typically 1-2%)

- Performance fees (often 15-20% above a hurdle rate)

- Administrative costs

Some vehicles offer more cost-effective access than others. Business Development Companies (BDCs) provide lower operating expenses compared to traditional private credit funds, though they may have other limitations.

To properly evaluate a private credit investment, break down its return components into alpha and beta elements. This helps you determine if outperformance justifies the fee structure.

The Illiquidity Premium and Investment Horizon

Private credit’s illiquidity premium represents additional yield compensation for committing capital for extended periods. Your investment horizon is crucial – can you lock up capital for 3-7 years? This commitment delivers tangible portfolio benefits.

Research suggests allocating 5% each from stocks and bonds to fund a private credit position may enhance returns while reducing overall portfolio risk. This improved risk-adjusted return profile (Sharpe ratio) stems from private credit’s low correlation with public markets.

Consider these factors when evaluating illiquidity tradeoffs:

- Your liquidity needs during different market environments

- Diversification benefits across your entire portfolio

- The premium yield compared to public equivalents

Some private credit vehicles offer secondary market trading options, providing a potential exit path before maturity, though often at a discount to NAV.

Macro Factors Influencing Private Credit Investments

Private credit investments are significantly shaped by broader economic conditions that can impact both returns and risk profiles. Understanding these factors can help investors better position their portfolios to weather various market environments.

Influence of Economic Growth and Inflation

Economic growth trajectories directly impact borrowers’ ability to service debt obligations. During periods of robust economic growth, default rates typically decrease as companies experience stronger cash flows and improved operational performance.

Conversely, economic downturns can stress borrowers’ balance sheets, potentially leading to higher default rates. This dynamic creates opportunities for well-positioned private credit managers who can provide capital when traditional sources retreat.

Inflation affects private credit investments in multiple ways. Rising prices can benefit existing fixed-rate loans as the real value of repayments decreases. However, persistent inflation may pressure borrowers’ margins if they cannot pass costs to customers.

Private credit often includes floating-rate structures that can provide protection against inflation, adjusting returns upward as rates increase. This feature makes it particularly attractive to institutional investors seeking to diversify their portfolios during inflationary periods.

Interest Rates and Credit Cycles

Interest rate movements fundamentally affect private credit markets. When rates rise, traditional financing sources often become more restrictive, creating a favorable environment for private credit providers who can step in to fill funding gaps.

You can take advantage of this dynamic by increasing allocations to private credit during periods of monetary tightening. The illiquidity premium typically expands during these phases, potentially enhancing your risk-adjusted returns.

Credit cycles also play a crucial role in determining optimal private credit exposure. During the expansion phase, looser underwriting standards may prevail, warranting caution. In contrast, distressed cycles often present compelling opportunities for disciplined investors.

Disclaimer:

This page contains mentions of publicly traded securities. This is not a recommendation to buy, sell, or trade said securities or their derivatives. Consult a financial advisor for your specific situation. Please visit my personal portfolio to see my financial positions for clarity of my biases or inclinations. This page contains links to other sites that compensate me for referrals.