Since my last update back in August, I got a raise at my current job, have been looking for a new job to build a career in a different field, and made another large purchase for a new car. For Portfolio Literacy, I have recently updated the calculators on the site, so they are more beneficial and have been revamping old content for relevancy. About my personal portfolio, I have continued to sell out of SoFi, it is no longer the major position that it used to be in my portfolio. I wanted to move to more value-oriented positions in my portfolio with VGK, SCHD, and BRK.

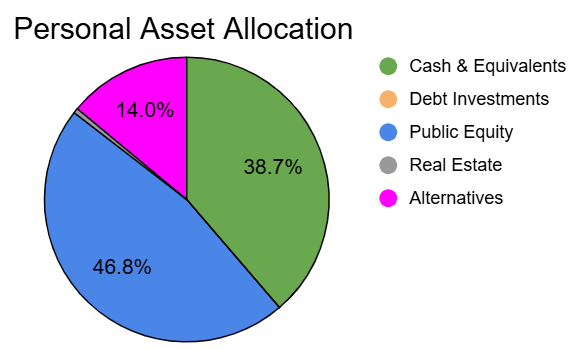

Portfolio Allocation:

Cash & Equivalents (38.7%): Cash & 1-month US Treasuries

Debt Investments (0.0%): US Treasuries, US I-Bonds, and CDs with maturities greater than 1 month

Public Equity (46.8%): Publicly traded stocks and ETFs

Real Estate (0.5%): Fundrise investment (80% appreciation focused, 20% income focused)

Alternatives (14%): Small business ventures, my car, and a credit contract

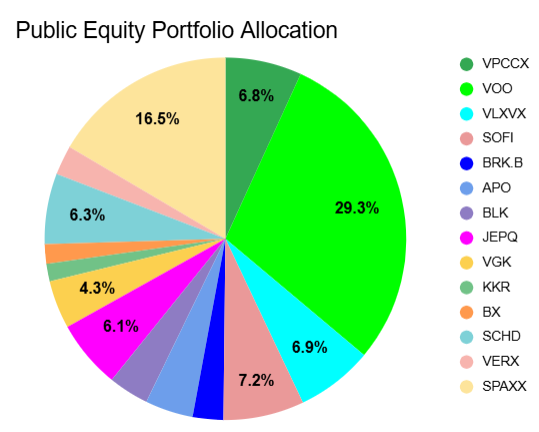

Public Equity Portfolio Allocation:

Thoughts on Public Equity

- Had nearly a 300% return on SoFi, which I am very proud about. Now I want to protect my gains with exposure to more value companies.

- I’m still looking for a more concentrated European equity investment but have been adding to VGK for broad Europe exposure.

- Made new investments in VERX and UNH, but I have since sold UNH after Berkshire Hathaway announced a position.

- Current positions I added to: BRK.B, BLK, SCHD, and VGK.

- Previously, 21% of my ‘equity’ portfolio is in a money market fund, now it is 16%. I try to deploy the capital, so my equity portfolio is not so “risk-off”, however I have been locking in gains on some of my best performers

- My YTD return in equities: +19.6%

My Overall Thoughts

- I have been working on revamping old articles on the blog and writing up new content lately.

- I recently bought a new car because my previous car needed to be replaced. I have depreciated it in my valuation however if it needed to be sold today it has decent value.

- Taking on low costing debt to buy a car does alter the total change in value of my assets, at year end I will go into detail about my debt and net worth.

- The value of my assets YTD: +26.83%

Disclaimer:

This page contains mentions of publicly traded securities. This is not a recommendation to buy, sell, or trade said securities or their derivatives. Consult a financial advisor for your specific situation. This page contains links to other sites that compensate me for referrals.