I want to share my portfolio to provide a learning experience for others based on my failures and successes, to be transparent about my personal financial interests, and to gain feedback from others. The plan is to make these portfolio updates on a somewhat regular basis. I will include snapshots of my portfolio from Google Sheets and my thoughts on a few aspects of my portfolio when I do. I have used Google Sheets for the last 5 years to keep track of my entire portfolio because it easily updates in real time.

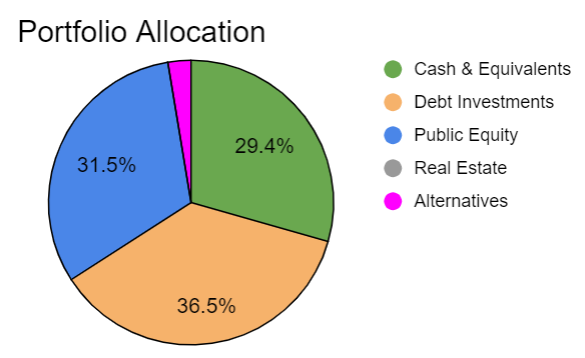

Portfolio Allocation:

Cash & Equivalents (29.4%): Cash & 1-month US Treasuries

Debt Investments (36.5%): US Treasuries, US I-Bonds, and CDs with maturities greater than 1 month

Public Equity (31.5%): Publicly traded stocks and ETFs

Real Estate (0.0%): None at this time

Alternatives (2.6%): Small businesses and internet projects I have invested in, valued at the cost of my investment

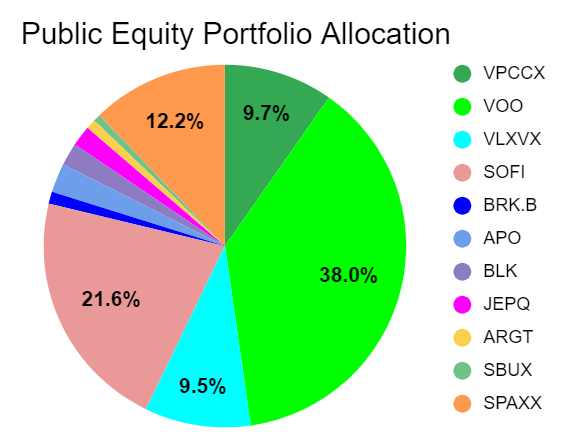

Public Equity Portfolio Allocations:

Thoughts on Public Equity

- I have significant concentration risk in SoFi, it’s a huge 21.6% of my equity portfolio and roughly about 6.8% of my overall portfolio. My position in SoFi has maintained its weight from my last update due to its recent strong performance. I still sell covered calls against my position to collect the premium on it and invest in VOO.

- I have exited my previous GameStop position with a gross return of 7.2%. The position was open for about 2.5 months which is a good return however definitely a risky play for only 7.2%.

- Starbucks announced a replacement of their CEO which caused a huge 24.5% appreciation in the stock. We will see if the new CEO is worth the hype. I entered into this position after it significantly declined due to poor earnings.

- SPAXX is a temporary position for uninvested cash from dividends, exiting GME, and covered calls on SoFi. This cash will be deployed for opportunities with a low-cost basis and for VOO.

My Overall Thoughts

- My cash and bond allocations are very heavy for my age, which have the opportunity cost of not being more invested in the public market. This is for the intent of buying a primary residence soon.

- Moved a lot of money into 3-month US treasuries before the Fed cut is anticipated in September. As all other rates will go down like HYSA and CDs, this is the best move I can make to keep growing my cash for a down payment for the future.

- I got a nice raise and bonus recently which has led to more money being saved and more money being invested. Earning more money is never a bad thing.

- I have renamed the Private Equity section of my portfolio to Alternatives to account for non-PE investments. No new investments have been made but, in the future, that will change.

Disclaimer:

This page contains mentions of publicly traded securities. This is not a recommendation to buy, sell, or trade said securities. Consult a financial advisor for your specific situation.