Since my last update back in September, I have simplified my equity positions, added a little exposure to Bitcoin when it fell below $100K, began building a sizeable position in a SaaS company, and became a licensed CPA. My updated portfolio is below.

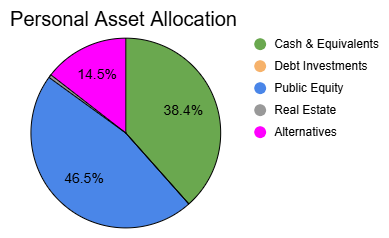

Portfolio Allocation:

Cash & Equivalents (38.5%): Cash & 1-month US Treasuries

Debt Investments (0.0%): US Treasuries, US I-Bonds, and CDs with maturities greater than 1 month

Public Equity (46.5%): Publicly traded stocks and ETFs

Real Estate (0.5%): Fundrise investment (80% appreciation focused, 20% income focused)

Alternatives (14.5%): Bitcoin, small business ventures, my car, and a private credit contract

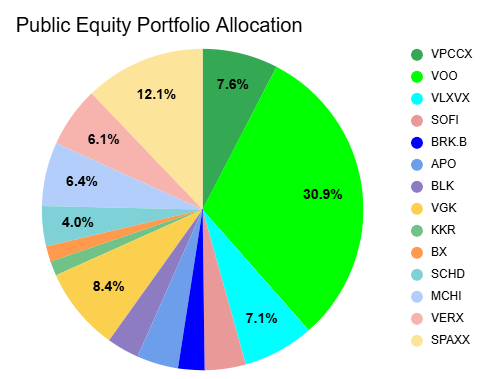

Public Equity Portfolio Allocation:

Thoughts on Public Equity

- I have reduced my SoFi position further, locking in strong gains for the year.

- I have 15% of my portfolio outside of the US, I continue to believe Europe will do well even if the US Dollar gains against the Euro next year.

- I loaded up on VERX shares and call options after the earnings miss. My exposure is about 80% shares and 20% call options.

- I closed my JEPQ position as I do not want to hold covered call funds anymore. I understood that covered call funds underperformed the underlying assets before yet saw them as investments to reduce volatility. However, after watching Ben Felix’s videos on the topic, I am not fond of covered call funds.

- My YTD return in equities: +23.51%

My Overall Thoughts

- I officially became a licensed CPA in October. I am looking forward to the opportunities that are soon to come.

- Now that I have more free time and do not need to study, I am trying to play around with AI tools more and build things. Most AI tools are neat but have not found anything exciting to pursue yet.

- Added a small position to Bitcoin, a position I may build on if crypto begins to have reasonable use cases for me personally.

- The value of my assets YTD: +27.6%

Disclaimer:

This page contains mentions of publicly traded securities. This is not a recommendation to buy, sell, or trade said securities or their derivatives. Consult a financial advisor for your specific situation. This page contains links to other sites that compensate me for referrals.