Since my last update right after Liberation Day, I bought the dip and added to a few positions I already had, added a popular defensive ETF to my portfolio, and stayed vigilant in my holdings. Thankfully the markets have recovered but not much growth beyond recovery. I am aiming to add more defensive positions in my portfolio due to my significant positioning into the S&P 500.

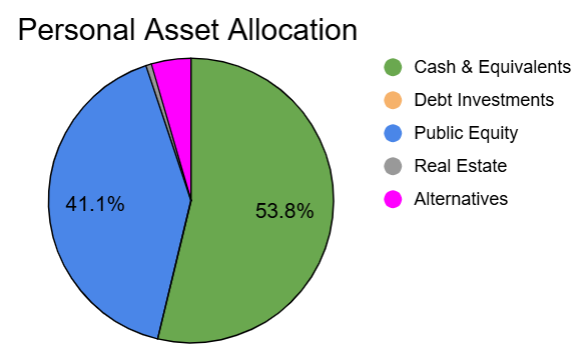

Portfolio Allocation:

Cash & Equivalents (53.8%): Cash & 1-month US Treasuries

Debt Investments (0.0%): US Treasuries, US I-Bonds, and CDs with maturities greater than 1 month

Public Equity (41.1%): Publicly traded stocks and ETFs

Real Estate (0.6%): Fundrise investment (80% appreciation focused, 20% income focused)

Alternatives (4.5%): Small business ventures (valued at the cost of my investment)

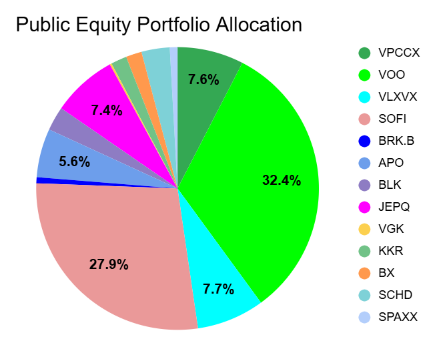

Public Equity Portfolio Allocation:

Thoughts on Public Equity

- SoFi is still a major position in my portfolio, I added to it at $9 a share after Liberation Day. I am currently selling covered calls against my shares at multiple strike prices to unload my position over time if it continues to go up.

- I am not looking to build a dividend portfolio; however, I added more to $JEPQ and started a $SCHD position. My plan is to use the dividend income to rebalance my portfolio overtime and take a smaller defensive position in my portfolio.

- Until earlier this month, my portfolio was +95% in US assets, my future plan is to get more global exposure for my equity portfolio, so I have been added $VGK for Europe exposure.

- My YTD return in equities: 4.92%

My Overall Thoughts

- I am still finishing my CPA and once I am done, I will be working more on finding a new job and Portfolio Literacy.

- My overall portfolio value YTD: 13.05%

Disclaimer:

This page contains mentions of publicly traded securities. This is not a recommendation to buy, sell, or trade said securities or their derivatives. Consult a financial advisor for your specific situation.