I want to share my portfolio to provide a learning experience for others based on my failures and successes, to be transparent about my personal financial interests, and to gain feedback from others. The plan is to make these portfolio updates on a somewhat regular basis. I will include snapshots of my portfolio from Google Sheets and my thoughts on a few aspects of my portfolio when I do. I have used Google Sheets for the last 5 years to keep track of my entire portfolio because it easily updates in real time.

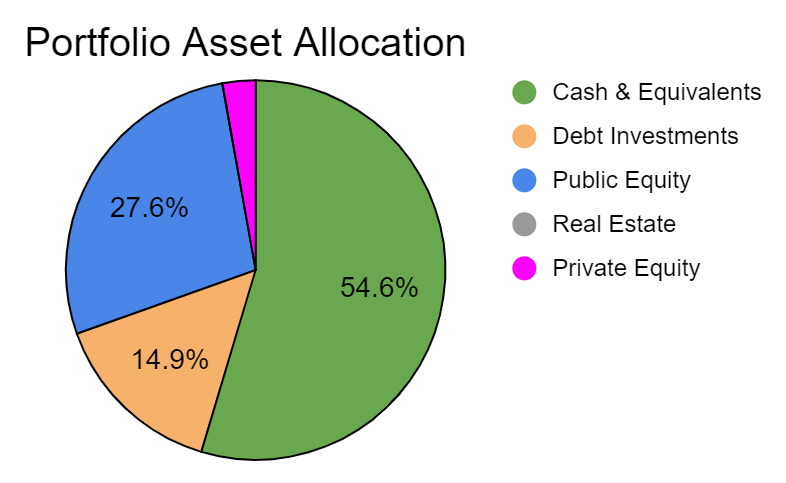

Portfolio Allocation:

Cash & Equivalents (54.6%): Cash & 1 month US Treasuries

Debt Investments (14.9%): US Treasuries, US I-Bonds, and CDs with maturities greater than 1 month

Public Equity (27.6%): Publicly traded stocks and ETFs

Real Estate (0.0%): None at this time

Private Equity (2.9%): Small businesses and internet projects I have invested in, valued at the cost of my investment

Public Equity Portfolio Allocations:

Thoughts on Public Equity

- I have significant concentration risk in SoFi, it’s a huge 22.4% of my equity portfolio and roughly about 6.2% of my overall portfolio. My position in SoFi has grown from wheeling options it has grown to be a significant position in my portfolio. I still sell covered calls against my position to reduce the concentration risk.

- I have concentration risk in the financial sector, without even accounting for the holdings within the ETFs, I have 30% of my stock portfolio in the financial services industry.

- GameStop is here due to its volatility recently in May 2024. I had entered the position by wheeling options on it and effectively have a $15 per share cost basis for GME. My goal here is to sell covered calls until the options are exercised.

- My future rebalancing will definitely be towards more index funds due to my SoFi and financial sector concentration.

My Overall Thoughts

- My cash and bond allocations are very heavy for my age, which have the opportunity cost of not being more invested in the public market. This is for the intent of buying a primary residence soon.

- New cash will be going into treasuries for my down payment on a primary residence to reduce the concentration of SoFi in my overall portfolio. I do not plan on investing new cash into projects unless it is cash that those projects are generating, reinvested into growing the business.

- Housing market is tough in California right now, it makes holding cash feel bad when the stock market keeps going higher and higher.

- I currently have about 10K in student debt, and no other debt, so there is no point in putting up a big red circle saying 100% student debt. My interest on my cash alone covers my monthly payments on the debt, so I am not stressing about it. However, I am actively making additional payments to get rid of it faster.

Disclaimer:

This page contains mentions of publicly traded securities. This is not a recommendation to buy, sell, or trade said securities. Consult a financial advisor for your specific situation.