Happy New Year everyone! Before 2025 ended, I made some changes to my portfolio to position myself for a smoother portfolio return. I am really happy for how 2025 went (both financially and personally) and I am looking forward to what 2026 has in store.

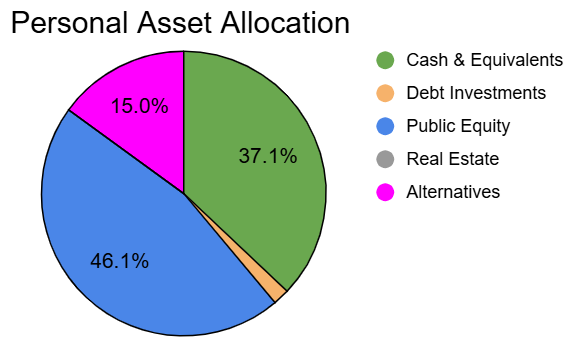

Portfolio Allocation:

Cash & Equivalents (37.1%): Cash & 1-month US Treasuries

Debt Investments (1.8%): US Treasuries, US I-Bonds, Credit ETFs, and CDs with maturities greater than 1 month

Public Equity (46.1%): Publicly traded stocks and ETFs

Real Estate (0.0%): No direct real estate ownership

Alternatives (15.0%): Small businesses and internet projects I have invested in, Fundrise, and Bitcoin holdings

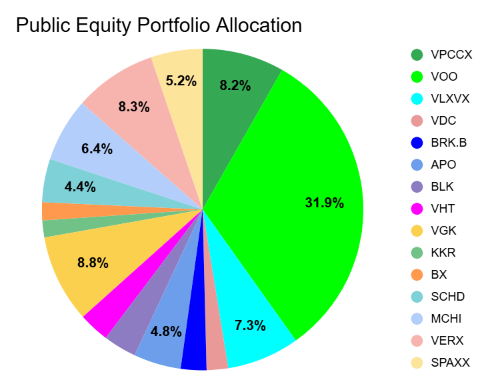

Public Equity Portfolio Allocation:

Thoughts on Public Equity

- I have closed out of SoFi completely going into 2026 as it has provided excellent returns for my portfolio, but it is out of my price range for holding it. I want to stay disciplined and stay out of it for now.

- I made new positions in VHT and VDC to expand my exposure in healthcare and consumer staples. The healthcare industry has been trading at lower P/E compared to recent years and it pairs well with my alternative asset managers.

- VERX continues to take a beating however, I believe it will turn around later this year. They are still growing sales just not as fast as anticipated in recent quarters.

My Overall Thoughts

- I have added a CLO fund to my investment portfolio to smooth out returns. I want to smooth out future returns in my investment portfolio with it.

- I am happy with how 2025 went, and I hope 2026 brings the same returns and life changes.

- I changed how I recognized my Fundrise account as it is not direct ownership in real estate and it includes private credit in the account.

Disclaimer:

This page contains mentions of publicly traded securities. This is not a recommendation to buy, sell, or trade said securities or their derivatives. Consult a financial advisor for your specific situation.