Since my last update at the start of January, I have been making some changes to the site with monetization updates and more types of content. I had 2 new investments in my portfolio with Fundrise and UEC. I added UEC to capture the anticipated growth in nuclear.

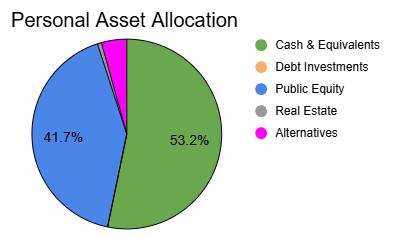

Portfolio Allocation:

Cash & Equivalents (53.2%): Cash & 1-month US Treasuries

Debt Investments (0.0%): US Treasuries, US I-Bonds, and CDs with maturities greater than 1 month

Public Equity (41.7%): Publicly traded stocks and ETFs

Real Estate (0.6%): Fundrise investment (80% appreciation focused, 20% income focused)

Alternatives (4.5%): Small businesses and internet projects I have invested in, valued at the cost of my investment

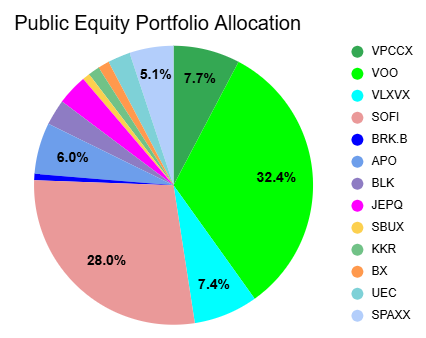

Public Equity Portfolio Allocation:

Thoughts on Public Equity

- SoFi is still a major position in my portfolio that I may trim down if it continues to trade upward rapidly. I do not have a price target, I just want to wait it out.

- My portfolio has been very volatile in recent weeks which I plan on reducing by buying more diversified positions in 2025.

My Overall Thoughts

- I have invested a small sum of money with Fundrise to get exposure to private credit and real estate. An immaterial amount for my portfolio growth long term but another financial matter than I can discuss on the blog long term.

- I spent more money than I budget for in January that I want to catch up on in 2025.

- I am about to take my 3rd CPA test, it is why there has been less posts lately.

Disclaimer:

This page contains mentions of publicly traded securities. This is not a recommendation to buy, sell, or trade said securities or their derivatives. Consult a financial advisor for your specific situation. This page contains links to other sites that compensate me for referrals.