Since my last update back in June, I passed my CPA exams and completed the remaining college credits required to be licensed, locked in gains on half of my SoFi position, and incurred some major expenses. As I shift my focus after obtaining my license, I am going to focus on finding a new job to build my career and growing Portfolio Literacy. My first steps for growing Portfolio Literacy will be to commit to my 2025 goals in how I wanted to develop Portfolio Literacy and create more quality content.

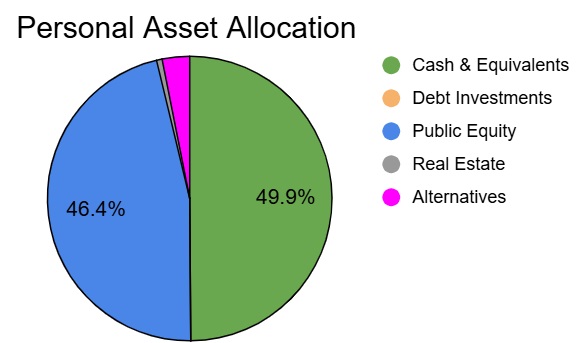

Portfolio Allocation:

Cash & Equivalents (49.9%): Cash & 1-month US Treasuries

Debt Investments (0.0%): US Treasuries, US I-Bonds, and CDs with maturities greater than 1 month

Public Equity (46.4%): Publicly traded stocks and ETFs

Real Estate (0.6%): Fundrise investment (80% appreciation focused, 20% income focused)

Alternatives (3.1%): Small business ventures (valued at the cost of my investment)

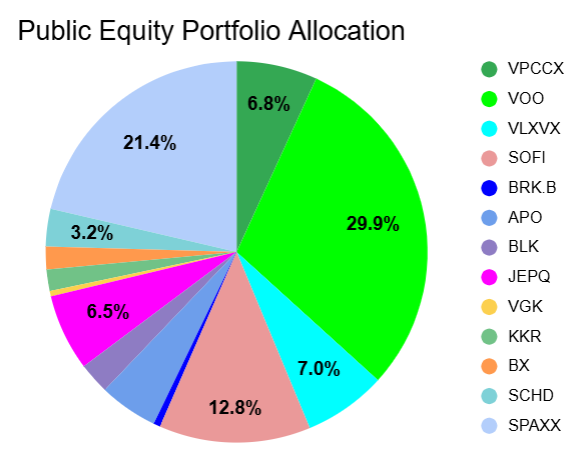

Public Equity Portfolio Allocation:

Thoughts on Public Equity

- I have locked in gains on 50% of my SoFi position and now I am taking my next steps slowly when it comes to reinvesting the gains.

- As mentioned in my last update, I want more global exposure. I will be adding to my current position in $VGK but also for concentrated European investments.

- Interest rates look like they may come down a little bit by year end, I may allocate to rate sensitive companies to capture that upside.

- My YTD return in equities: 15.21%

My Overall Thoughts

- I have been working on revamping old articles on the blog and writing up new content lately.

- I recently paid for my 5th year of college education to meet my CPA requirements. I did spend a lot more than usual lately however it will be worth the investment for my career and future income potential.

- My overall portfolio value YTD: 18.28%

Disclaimer:

This page contains mentions of publicly traded securities. This is not a recommendation to buy, sell, or trade said securities or their derivatives. Consult a financial advisor for your specific situation.