I want to share my portfolio to provide a learning experience for others based on my failures and successes, to be transparent about my personal financial interests, and to gain feedback from others. If you want detailed insights on my portfolio, you can follow my portfolio updates, but if you only want general portfolio allocation information you can check this page regularly.

My goals are just that, mine. I am in my 20s, growing in my career, and looking to buy a house in the near future. My life situation is likely to be different than yours, just because I structure my portfolio the way I do, does not mean it’s appropriate for you to copy my investments. You should do your own analysis to figure out what investments are right for you and your situation before investing.

This page is updated as of January 1st, 2026

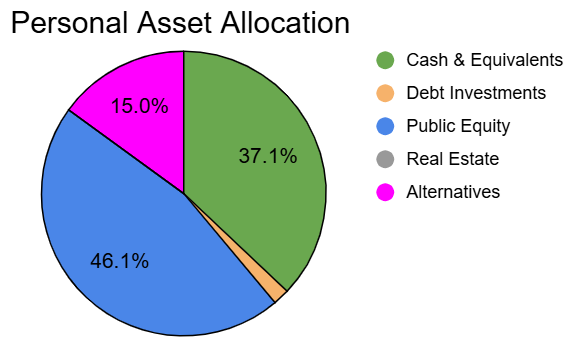

Portfolio Allocation:

Cash & Equivalents (37.1%): Cash & 1-month US Treasuries

Debt Investments (1.8%): US Treasuries, US I-Bonds, Credit ETFs, and CDs with maturities greater than 1 month

Public Equity (46.1%): Publicly traded stocks and ETFs

Real Estate (0.0%): No direct real estate ownership

Alternatives (15.0%): Small businesses and internet projects I have invested in, Fundrise, and Bitcoin holdings

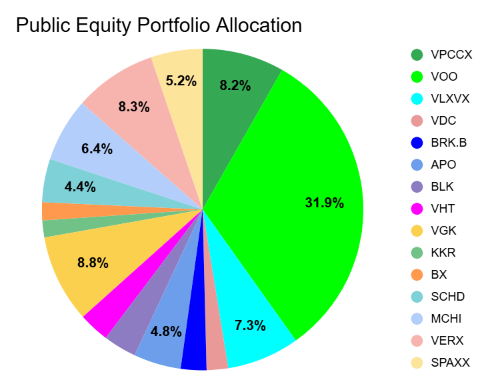

Public Equity Portfolio Allocation:

Allocation of New Cash to my Portfolio:

At this time, new cash will be going into treasuries to build up my down payment on a primary residence, and regular retirement account contributions. I do not plan on investing new cash into projects unless I see unique asymmetric opportunities. I have been making recent investments in my career which I hope will pay off in the coming years.

Capital Allocation Methodology:

My capital allocation methodology starts with liquidity and optionality, then works outward to risk assets. Because I am in my 20s and trying to buy my primary residence in the near term, I prioritize saving cash and short-duration Treasuries. Next, I treat retirement contributions as a recurring base allocation that happens regardless of what is going on in the world. Only after those two priorities are satisfied do I make more granular investment decisions.

I tend to invest in companies I am familiar with and where I see long term return potential. If I am ever wrong in the short term, I do typically average down on my position. I am working on being a more disciplined investor, when I start a position and when I exit it.

Disclaimer:

This page contains mentions of publicly traded securities. This is not a recommendation to buy, sell, or trade said securities or their derivatives. Consult a financial advisor for your specific situation. This page contains links to other sites that compensate me for referrals.