Since my last update back in February, I had covered calls expire and sold my Starbucks position providing me more cash, made regular investments through my work 401(k), and my cash savings have gone up due less spending in the end of February and March. Markets absolutely plummeted due to ‘Liberation Day’, the drastic tariffs being placed on the US trade partners. My portfolio was not spared, lol. Unfortunately, this week reminds me of the days I used to spend trading Wall Street Bets meme stocks and seeing double digit percent losses.

Portfolio Allocation:

Cash & Equivalents (58.6%): Cash & 1-month US Treasuries

Debt Investments (0.0%): US Treasuries, US I-Bonds, and CDs with maturities greater than 1 month

Public Equity (35.8%): Publicly traded stocks and ETFs

Real Estate (0.8%): Fundrise investment (80% appreciation focused, 20% income focused)

Alternatives (4.8%): Small business ventures (valued at the cost of my investment)

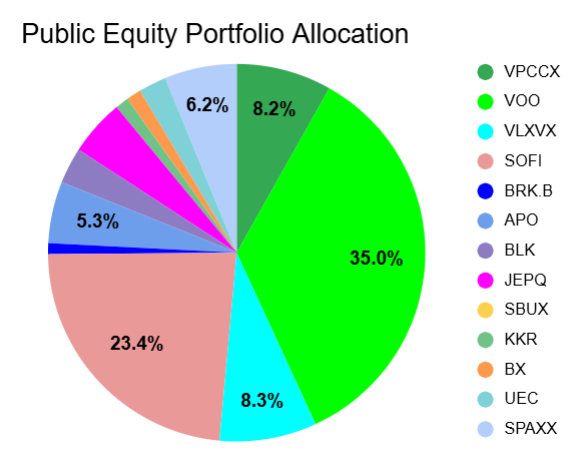

Public Equity Portfolio Allocation:

Thoughts on Public Equity

- SoFi is still a major position in my portfolio, earnings is coming up and I do not want to exit the position amidst the volatility of tariffs or earnings.

- My time horizon is long term as most of my equities are in retirement accounts. I will continue to invest in the broader market and may buy down my cost basis on a few holdings if they go lower.

- My YTD in equities: -24.19%

My Overall Thoughts

- I have been saving a lot more money just because I have been spending more time studying. My largest purchase in March was arranging my travel to Omaha for the 2025 Berkshire Hathaway annual shareholder meeting. Looking forward to the tariff commentary from Buffett that will inevitably be had there.

- I am not a tariff expert; I think this past weeks’ massive declines in the market are unfortunate for older investors who had significant equity exposure. For the younger investors, we should see this as a blessing for the long term because 20 years from now this is all irrelevant.

- I will start providing my YTD values/returns in my updates, I think it’s important in the name of transparency.

- My overall portfolio value YTD: -3.97%

Disclaimer:

This page contains mentions of publicly traded securities. This is not a recommendation to buy, sell, or trade said securities or their derivatives. Consult a financial advisor for your specific situation. This page contains links to other sites that compensate me for referrals.