Growing your net worth from $100K to $1M may seem challenging, but by starting your 100K Boglehead portfolio and continually investing, you will be on the path to $1M. This investment philosophy emphasizes simplicity and a long-term perspective, making it an excellent choice for new investors. By focusing on a diversified portfolio and minimizing costs, you can increase your chances of reaching the $1M milestone.

Bogleheads.org or r/Bogleheads are great places to browse and learn John Bogle’s philosophy to investing and understand the importance of simplicity. You will learn to diversify your investments while keeping expenses down using a 3-fund portfolio model, always investing in the market, and why patience are all vital in your wealth-building journey.

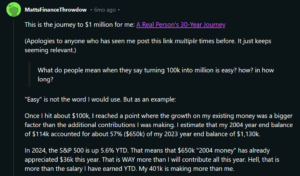

You can look at past discussions where individuals have reached their $1M net worth goal in 30 years. The same reddit user (MattsFinanceThrowdow) even mentioned that his original $100K accounted for 57% of his +$1M portfolio balance when he reached $1M.

This original reddit post is part of the influence in making this blog post which I hope encourages others to keep investing for their future.

Understanding Boglehead Principles

The Boglehead investment philosophy is designed around achieving steady financial growth through a structured and informed approach. It emphasizes low-cost, diversified investing and leverages communal wisdom, allowing investors to manage portfolios efficiently.

Foundation of Boglehead Approach

The Boglehead philosophy is rooted in the investment ideas of Jack Bogle, founder of Vanguard Group. These principles focus on long-term investing, maintaining a diverse portfolio, and keeping costs low. You are encouraged to adopt a “buy and hold” strategy, which minimizes the temptation to frequently trade based on market fluctuations. Such strategies are bolstered by studies in Modern Portfolio Theory, encouraging disciplined investment choices that yield steady returns, potentially transforming your initial 100K Boglehead portfolio into $1M over time, by relying on the power of compound growth and continuous investment.

Simplicity in Investment

Keeping things simple is a key aspect of the Boglehead philosophy. By choosing broad market index funds or low-cost ETFs, you are focusing on straightforward and transparent investments. This simplicity helps in reducing management fees and minimizing stress associated with active trading. A typical Boglehead portfolio might include a mix of the total stock market, international stock, and bond index funds. This straightforward approach not only simplifies decision-making processes but also allows you to focus on the larger picture of your financial goals.

Growing Your 100K Boglehead Portfolio to $1M

Growing your 100K Boglehead portfolio to $1M requires careful planning and strategic choices in asset allocation, tax-efficient investments, and choosing the right index funds. Staying invested in the market over time is crucial to maximizing returns.

Allocation of Assets

Asset allocation is a key part of growing your wealth. To balance risk and return, diversify your investments by asset class. For example, you might have a 60/40 portfolio where you allocate 60% to stocks and 40% to bonds, or you adjust that allocation based on your risk tolerance. For your stock allocation, consider VOO which tracks the S&P 500, or VTI which has broad exposure to more U.S. stocks.

Foreign stocks may also play a role in your allocation. Considering funds like VXUS can add global diversification to your portfolio, or if you want to allocate more to a specific non-US country you can add a country specific ETF. For your bond allocation, consider VBMFX or building your own bond ladder with treasury bonds. Keeping the right mix of assets and continuing to invest in your portfolio ensures smoother growth over time.

Tax Efficient Investment Location for Your 100K Boglehead Portfolio

Placing your investments in the right accounts can enhance your returns through tax efficiency. Consider using tax-advantaged accounts like Roth IRAs for stocks. These allow your investments to grow tax-free and you won’t pay taxes on withdrawals.

Taxable accounts can be used for tax-efficient funds. Funds that have low turnover, generate fewer taxable events and will benefit you if you have already maxed out your tax-advantaged accounts. If you have bonds or income-generating assets, placing them in tax-deferred accounts like a 401(k) can shield you from immediate taxes on interest income.

Always be Buying

Always be buying, or continuously investing, is a key strategy for growing your portfolio over time. By consistently adding to your investments, whether the market is up or down, you take advantage of dollar-cost averaging, which reduces the impact of market volatility. Regular investing helps you accumulate more shares at lower prices during market dips and increases your holdings steadily, regardless of market conditions. This disciplined approach ensures that your portfolio continues to grow as you keep adding capital, taking full advantage of compounding returns over time.

Additionally, continuously investing helps to build long-term wealth without trying to time the market, which is notoriously difficult. By sticking to a regular investment schedule, whether it’s monthly or quarterly, you reduce the emotional stress of market swings and maintain focus on your long-term financial goals. Over time, this steady approach can lead to significant growth in your portfolio, as consistent contributions and reinvested earnings compound, creating a larger and more resilient investment base.

Time in the Market

Patience is crucial when growing your portfolio to $1M. The power of compounding highlights the importance of staying invested over time. Frequent trading can hurt your returns due to fees and missed opportunities.

Maintaining a long-term view, regardless of market fluctuations, allows your investments to grow. Historical data indicates that a consistent investment in diversified funds, like the S&P 500, leads to significant returns over decades. Avoid reacting to short-term market changes and focus on your long-term goals. This strategy ensures steady growth and maximizes your portfolio’s potential like it did for Matt from the reddit post.

Try out our Future Value Calculator to analyze your current trajectory to having a $100K Boglehead Portfolio. If you already passed $100K, you could map out your path to $1M.

Disclaimer:

This post contains mentions of publicly traded securities. This post is not a recommendation to buy, sell, or trade said securities. Please visit my personal portfolio to see my financial positions for clarity of my biases or inclinations.