When it comes to managing significant wealth, a family office has become the gold standard for the ultra-wealthy. These entities, often private firms established to manage and preserve the wealth of affluent families, are known for their tailored approach for the family’s goals. One of the critical aspects of their operations is asset allocation, a practice that seeks to balance risk and reward by diversifying investments across various asset classes. JP Morgan’s recent analysis of family office portfolios by assets under management (AUM) sheds light on how these entities allocate their vast resources, and the findings are both insightful and instructive.

Unlike institutional investors or mutual funds, family offices cater exclusively to the needs of a single family or a small group of families. Their investment strategies are deeply personal, often reflecting the values, goals, and risk tolerance of the families they serve. This personalized approach to wealth management allows family offices to adopt long-term investment horizons, pursue niche opportunities, and, crucially, manage risk in a way that aligns with the family’s overall objectives.

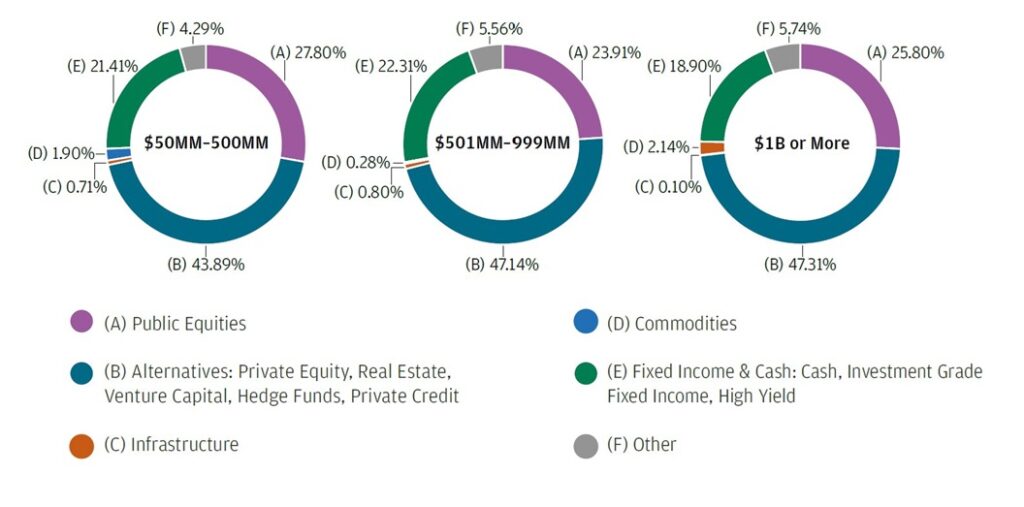

Family Office Allocation Data

The below photo is JP Morgan’s breakdown of family office portfolios by AUM (from their available data), I found it from X user Mr Family Office, he posts tons of information and context about family office investments, hirings, outlooks.

At first glance, they all have similar allocations. On average they all relatively follow the below allocation:

- 25% Public Equities

- 50% Alternatives

- 20% Fixed Income

- 5% Other

So, no matter the AUM, once you are pushing into the upper echelons of wealth, it blurs pretty close together how they allocate capital. They all got to this level of wealth differently, but they preserve it the same way through their allocations.

These are the wealthiest families building and preserving their wealth, and they have 50% allocations to alternative assets. I don’t think it’s a coincidence. This trend toward alternatives reflects broader market sentiment, where investors are increasingly looking beyond traditional asset classes to seek higher returns, manage risk, and tap into new opportunities. For family offices, the appeal of alternatives lies in their potential for outperformance, lower correlation with public markets, and the ability to invest in sectors or projects that align with the family’s values or interests.

When it comes to fixed income, the asset class’s conservative nature makes them an essential component of any portfolio, even at these high levels of wealth, offering stability and income generation, especially in volatile markets. For family offices, these assets are likely used to preserve wealth, provide liquidity, and balance the more volatile segments of their portfolios, such as public equities and alternatives. I would assume their average yield on fixed income is better than 5% just due to the investment opportunities available to them.

JP Morgan’s data provides a valuable snapshot of how family offices allocate their wealth across different asset classes, offering insights that can be instructive for investors of the ultra-wealthy (or those looking to achieve this level). For family offices, the art of portfolio allocation is not just about maximizing returns; it’s about aligning investments with the family’s broader objectives, managing risk, and ensuring the preservation of wealth across generations. As such, the insights from JP Morgan’s data offer a blueprint for how other investors might approach their own asset allocation decisions, particularly in an increasingly complex and uncertain investment landscape.