Assessing the role of I Bonds in your investment portfolio in 2025 is a significant consideration, particularly in an uncertain future when it comes to inflation. These bonds are specifically designed to protect against inflation, which may be a critical factor given the fluctuating rates experienced in recent years. As low-risk investments backed by the U.S. government, I Bonds could provide a stable component to your portfolio, offering a hedge against the eroding effects of inflation on your savings.

Evaluating the suitability of I Bonds for your portfolio involves understanding their return structure, which combines a fixed rate that remains constant over the life of the bond with a variable rate that adjusts for inflation every six months. From now until April 2025, the fixed rate is more pertinent as it is relatively high at 1.2%, complementing the inflation-adjusted rate to offer a competitive yield during times of high inflation. This, coupled with the tax advantages and the flexibility they offer in terms of redemption, makes them an attractive option for conservative investors seeking a reliable source of income.

Your portfolio allocation towards I Bonds would also depend on your overall risk tolerance, investment horizon, and income needs. Incorporating I Bonds can increase your portfolio’s resilience to economic shifts, however given their current yield of 3.11% they are not a good short term solution especially when the 6-month treasuries are offering more attractive yields. However, for long term investors I Bonds provide a more compelling case, more on that below.

Understanding I Bonds

Investing in Series I Savings Bonds (I Bonds) provide a hedge against inflation while offering a government-backed asset option for your portfolio.

What are Series I Savings Bonds?

I Bonds are a type of savings bond issued by the U.S. Department of the Treasury. They are designed to protect the purchasing power of your investment by earning interest that keeps up with inflation. I Bonds have both a long-term investment horizon and tax advantages, such as tax deferral until redemption or final maturity.

Key Characteristics:

- Tax Benefits: Interest earned is exempt from state and local taxes.

- Purchase Limitations: Individuals have annual purchase limits.

Interest Rates and Inflation

The return on I Bonds is driven by a composite rate, which combines a fixed rate that stays the same for the life of the bond with a variable rate that adjusts every six months according to the rate of inflation as measured by the Consumer Price Index (CPI).

Rate Components:

- Fixed Rate: Set upon purchase; remains constant.

- Variable Rate: Based on inflation, changes semiannually.

The interest on I Bonds is compounded semiannually, meaning your investment grows by a combination of the interest earned in the previous six months and the underlying principal. More information is available at TreasuryDirect. Understanding the unique structure of I Bonds can be crucial in determining if they suit your long-term financial goals, especially in an environment where inflation impacts the purchasing power of your savings.

Benefits of I Bonds in an Investment Strategy

When considering diversification and risk management in your portfolio, I Bonds offer unique advantages that are tailored to protect against inflation and provide tax-efficiency.

Hedge Against Inflation

I Bonds are designed to offer you a low-risk investment that keeps pace with inflation. This is achieved through an inflation-adjusted rate that changes semi-annually (in May and November), ensuring your investment’s purchasing power is maintained over time. I Bonds stand out as a unique asset that guarantee a real return against inflation, so long that it has a fixed component (which it has until April 2025), because the variable portion of the interest changes based on CPI.

Tax Advantages of I Bonds

Your investment in I Bonds also comes with notable tax advantages. The interest earned is exempt from state and local taxes, which enhances your after-tax returns. Moreover, you have the option to defer federal taxes on the earnings until redemption or final maturity, offering a strategic benefit for your long-term savings goals. For educational expenditures, under certain conditions, you might also qualify for tax-free interest.

Potential Limitations and Risks

Investing in I-Bonds may seem advantageous, especially during periods of high inflation, but it’s important to be aware of the potential limitations and risks that may impact your portfolio. As you consider their inclusion, weigh the aspects of penalties and illiquidity, as well as interest rate considerations, which could affect your financial strategy.

Penalties and Illiquidity

When you purchase I-Bonds, you must hold them for at least one year before you can redeem them; selling before five years incurs a penalty of the last three months’ interest. This makes I-Bonds inherently illiquid in the short term, so they may not suit your needs if immediate access to funds is a priority.

Interest Rate Considerations

I-Bonds have a composite rate determined by a fixed rate and an inflation rate that is adjusted semi-annually. While this can protect against inflation risk, it presents a limitation if deflation occurs, or if market interest rates rise substantially above the I-Bonds’ rates.

Since the fixed rate remains constant for the life of the bond, your I Bonds may lag in a rising rate environment, limiting their effectiveness as fixed income tools. They will only exceed inflation returns with the fixed rate component, which will not be substantial as at the time of this post is 1.3%. I Bonds, are not meant to huge winners but rather a hedge against inflation. As inflation cools from Covid Era highs of +9%, I Bonds will work their way down in yield as the Federal Reserve combats inflation. They will only become super high return assets when inflation rises.

Incorporating I Bonds Into Your Portfolio for the Long Term

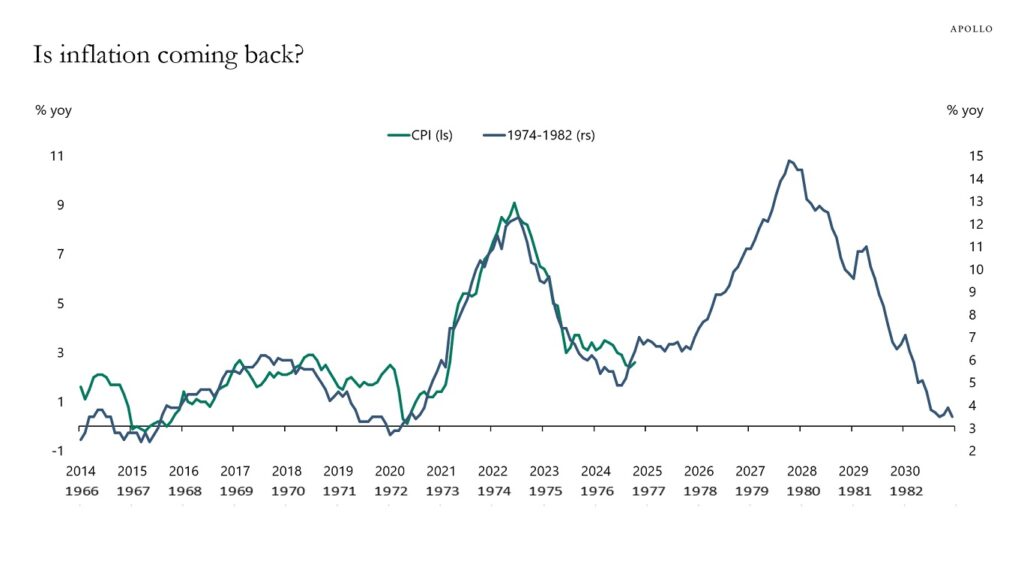

The case for I Bonds in 2025 is their fixed rate component. If you believe inflation may be coming back with a vengeance, as it did in the 1980s, then buying I Bonds while they offer a relatively attractive fixed component is a pretty good idea as the yield will move with CPI. Below is a chart from ApolloAcademy.com and it shows the 1980s compared to now.

The resemblance is there unfortunately; however, it does not mean its guaranteed. So, does this mean buy I Bonds like crazy to have real returns in the future? No, it means if you are long term investor and want to build a diversified portfolio, having I Bonds (preferably with a fixed income component) is not a bad idea. You can have both a treasury bill ladder and an investment in I Bonds.

If you already have I Bonds with a fixed rate component in your portfolio, you do not need to exit your I Bond position, and you also do not need to buy more. You can go with the treasury bill ladder if you are working on the fixed income side of your portfolio or allocate more to equities. I Bonds are an option only for guaranteed real returns, but if inflation is low I Bonds are not a favorable investment.

Purchasing and Managing I Bonds

When considering I Bonds for your investment portfolio, it’s essential to understand the purchasing process through TreasuryDirect and the specifics around holding periods and maturity dates. These bonds represent a unique savings tool backed by the U.S. government, offering a blend of safety and inflation protection.

Buying I Bonds Through TreasuryDirect

To purchase electronic I Bonds, you must first set up an account on TreasuryDirect. This platform allows you to buy, manage, and redeem your savings bonds online. The process for buying is straightforward:

- Register for an individual TreasuryDirect account.

- Navigate to the BuyDirect® tab once you’re logged in.

- Select I Bonds and enter the purchase amount.

- Review and Submit your transaction.

Be aware that you may buy electronic I Bonds in any denomination starting at $25 up to $10,000 each calendar year. As for paper I Bonds, a purchase option is available when using an IRS tax refund, with a maximum of $5,000 per tax return.

Holding Periods and Maturity Dates

An important aspect of I Bonds is the duration for which you hold them. Here’s what you need to know:

- Minimum holding period: 1 year

- Penalty: If redeemed before 5 years, you forfeit the last 3 months’ interest.

- Maturity date: I Bonds reach full maturity in 30 years, which is when they stop earning interest.

During the holding period, your I Bond’s interest will compound semiannually. This means the U.S. government recalculates the interest rate every six months based on inflation, which directly influences your bond’s return. Keep in mind that while I Bonds provide a reliable and predictable form of investment, accessing funds before five years results in the aforementioned penalty.

If you are interested in building your fixed income or credit portfolio, check out this post on private credit, a rapidly growing asset class in recent years.

The allocation of I Bonds in your portfolio will depend on your long-term investment objectives and the current economic environment, which is why consulting a professional will be beneficial for your exact scenario.