One of the most common frameworks in personal finance is the 50/30/20 budget rule: 50% of income goes toward needs, 30% toward wants, and 20% toward savings. But what if you flipped that logic and used it as a way to structure your investment portfolio? That’s where the 50/30/20 portfolio comes in. As a Boglehead-style investor, someone who believes in low-cost, diversified, index-fund investing, this structure can be a simple yet effective way to balance growth, stability, and income. At the end we will go over a technical back test that was performed.

What Is the 50/30/20 Portfolio?

The 50/30/20 portfolio allocates assets into three main buckets:

- 50% Stocks – The engine of growth, invested broadly in U.S. and/or international equities.

- 30% Bonds – The stabilizer, designed to reduce volatility and provide predictable returns.

- 20% Alternatives – A flexible portion that can be used for REITs or commodities depending on the investor’s needs.

This setup appeals to Boglehead investors because it’s easy to replicate with a 3-fund portfolio approach using low-cost index funds and ETFs.

Step 1: The Stock Allocation (50%)

As a Boglehead, the goal is broad diversification at the lowest cost possible. Instead of stock-picking or chasing trends, you can stick to low-cost total market index funds like VTI, VT, or VOO.

- Vanguard Total Stock Market ETF (VTI) – Covers large-, mid-, and small-cap stocks across the U.S. economy.

- Vanguard Total World Stock ETF (VT) – It includes the US market and provides exposure to developed and emerging markets outside the U.S.

- Vanguard S&P 500 ETF (VOO) – Covers large-cap US companies and excludes small-caps.

By allocating your stock fund to any of these low-cost funds, you give your portfolio a chance to capture strong returns.

Step 2: The Bond Allocation (30%)

Bonds serve as the cushion in your portfolio. While they don’t deliver the same growth potential as stocks, they protect your portfolio in downturns.

- Vanguard Total World Bond ETF (BNDW) – A diversified mix of government and corporate bonds from all over the world, weighted 50% US and 50% international.

- Vanguard Total International Bond ETF (BNDX) – An allocation of international bonds that are currency hedged to the US dollar so changes in exchange rates minimally impacts performance.

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB) – This is not a typical Boglehead type fund as it has a relatively higher expense ratio (.39%), but it does not use currency hedging that BNDX does. So, if the US dollar declines vs other currencies, EMB performs better than BNDX.

For Bogleheads, the key is to avoid high-fee bond funds or chasing yield. Simple, broad exposure is usually enough however I would like to make sure Bogleheads are aware of all risks in their portfolio. Click here for more information on EMB vs BNDX.

Step 3: The Alternatives Allocation (20%)

The last slice of the portfolio adds flexibility. The standard 3-fund portfolio model calls for US equities, international equities, and bonds, this 3-fund portfolio model suggests for international diversification in equities and bonds and then. Others use it for diversifiers like REITs.

- Vanguard Real Estate ETF (VNQ) – Provides exposure to real estate, which doesn’t always move in lockstep with stocks and bonds. However, this ETF is exposed to US real estate.

- SPDR Gold Shares (GLD) – Gold is a hedge against inflation of the US dollar. It has significantly overperformed in recent years on a US dollar basis due to growing concern over US national debt.

This category is optional and can be tailored to your personal comfort level and risk appetite.

Why the 50/30/20 Portfolio Works for Bogleheads

The beauty of this portfolio is that it balances growth and defense while still being simple to manage using a 3-fund portfolio.

- Growth potential from a broad mix of U.S. and global stocks.

- Stability and income from high-quality bonds.

- Flexibility from alternatives like REITs or gold.

For Bogleheads, who want simplicity, diversification, and low costs, this strategy is aligned with the core principles of the movement.

Back Test VS Classic 3-Fund Portfolio

While reviewing potential allocation options for this article, I was curious to see a back test to a similarly weighted classic 3-fund portfolio. Here are the allocations, settings, and results.

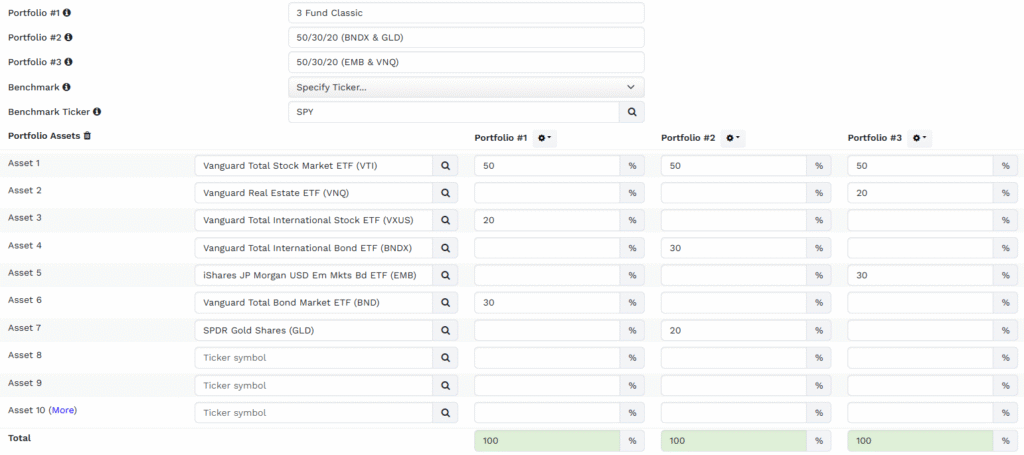

Back Test Allocations:

I paired BNDX with GLD and EMB with VNQ to hedge for inflation in the US dollar for the 50/30/20 portfolios. The classic 3-fund portfolio had exposure to international equities to hedge the US dollar. VTI was used for all portfolios to reduce differences between portfolios.

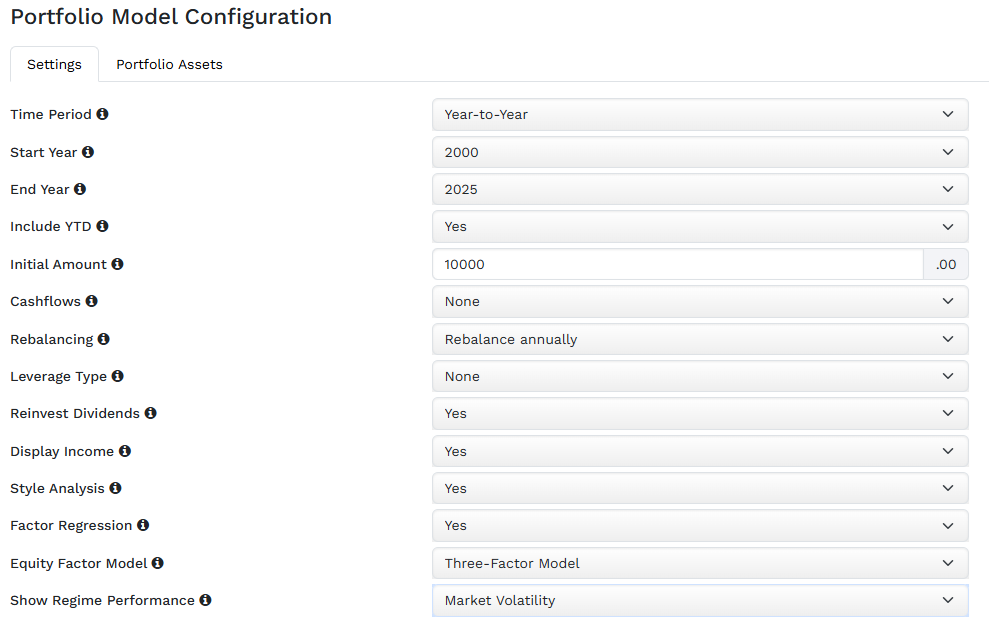

Back Test Settings:

The start year is listed as 2000 however, due to fund data limitations for one fund starting in 2016, the back test is only the last 10 years. All pictures shown are using these back test settings.

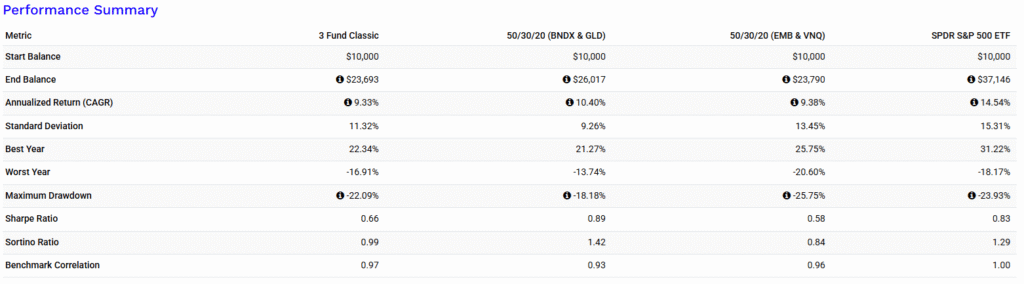

Back Test Results:

The best performing portfolio was the BNDX and GLD portfolio which also had the smallest drawdown and best worst year between the portfolios tested. The BNDX and GLD had the best metrics across the board when rebalanced annually. The worst performing portfolio is the classic 3-fund portfolio however it feels so minimal compared to the EMB and VNQ portfolio. I also tested if the portfolios were not rebalanced annually and if there was an annual addition of $1,000 to the portfolio, in both cases the BNDX and GLD portfolio would still be the best performing across the board in terms of total return and risk metrics.

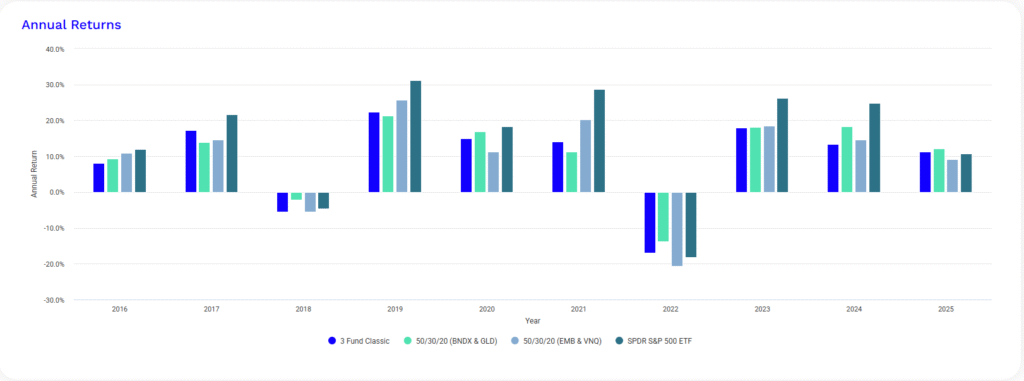

When returns are positive, the greater equity exposure does best. The S&P 500 benchmark outperformed the 3 tested portfolios. However, as mentioned earlier, the drawdowns for the BNDX and GLD portfolio were smallest.

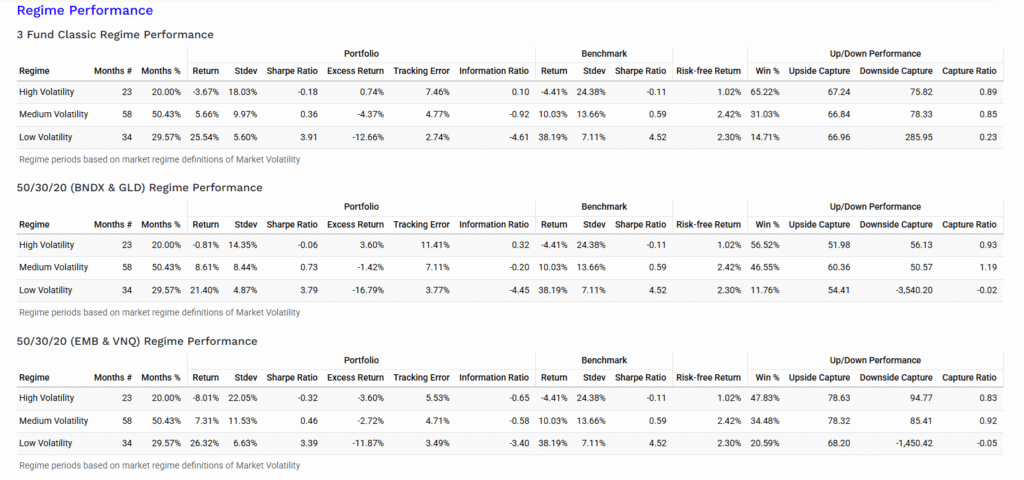

We are getting a little technical here but, this regime performance measures performance based on market environment per month during the time frame. The most frequent environment has been a medium volatility environment and BNDX and GLD performed best during that time frame even when it underperformed in high & low volatility environments compared to the other portfolios.

Final Thoughts

The 50/30/20 portfolio isn’t a magic formula, it’s a framework. Some investors may tilt toward more stocks if they have a long-time horizon, while others may increase bonds if they’re closer to retirement. What matters most is staying disciplined, keeping costs low, and allowing compounding to do its work over decades.

As Jack Bogle himself often reminded investors: “Don’t look for the needle in the haystack. Just buy the haystack.” The 50/30/20 portfolio is a straightforward way to own the haystack while still customizing your risk profile.

Disclaimer:

This post contains mentions of publicly traded securities. This post is not a recommendation to buy, sell, or trade said securities. Please visit my personal portfolio to see my financial positions for clarity of my biases or inclinations.